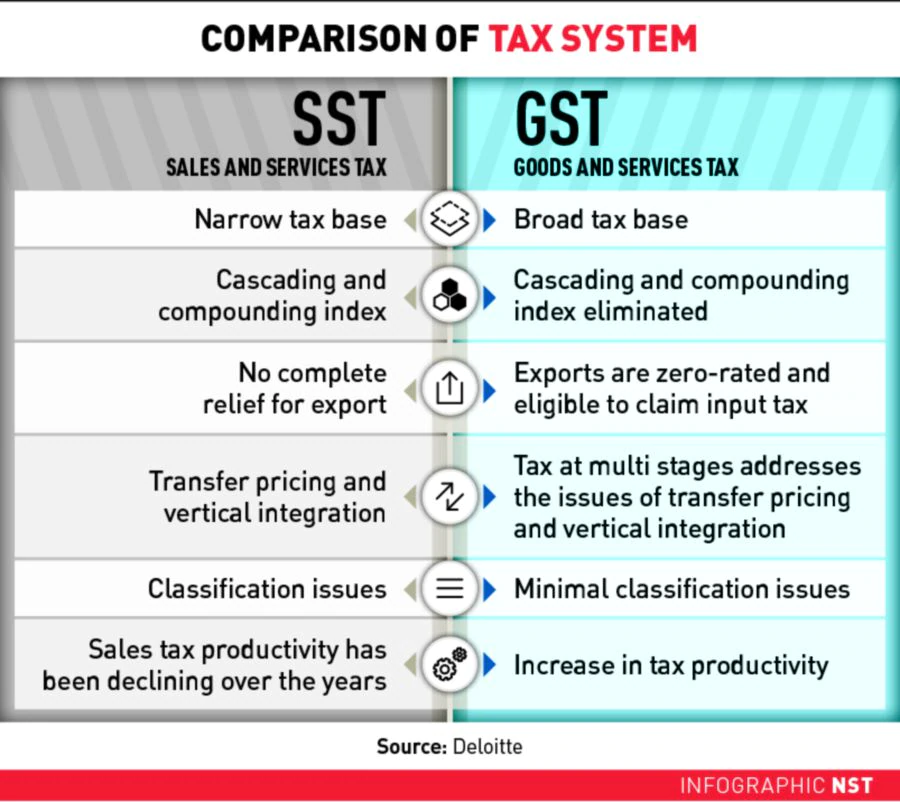

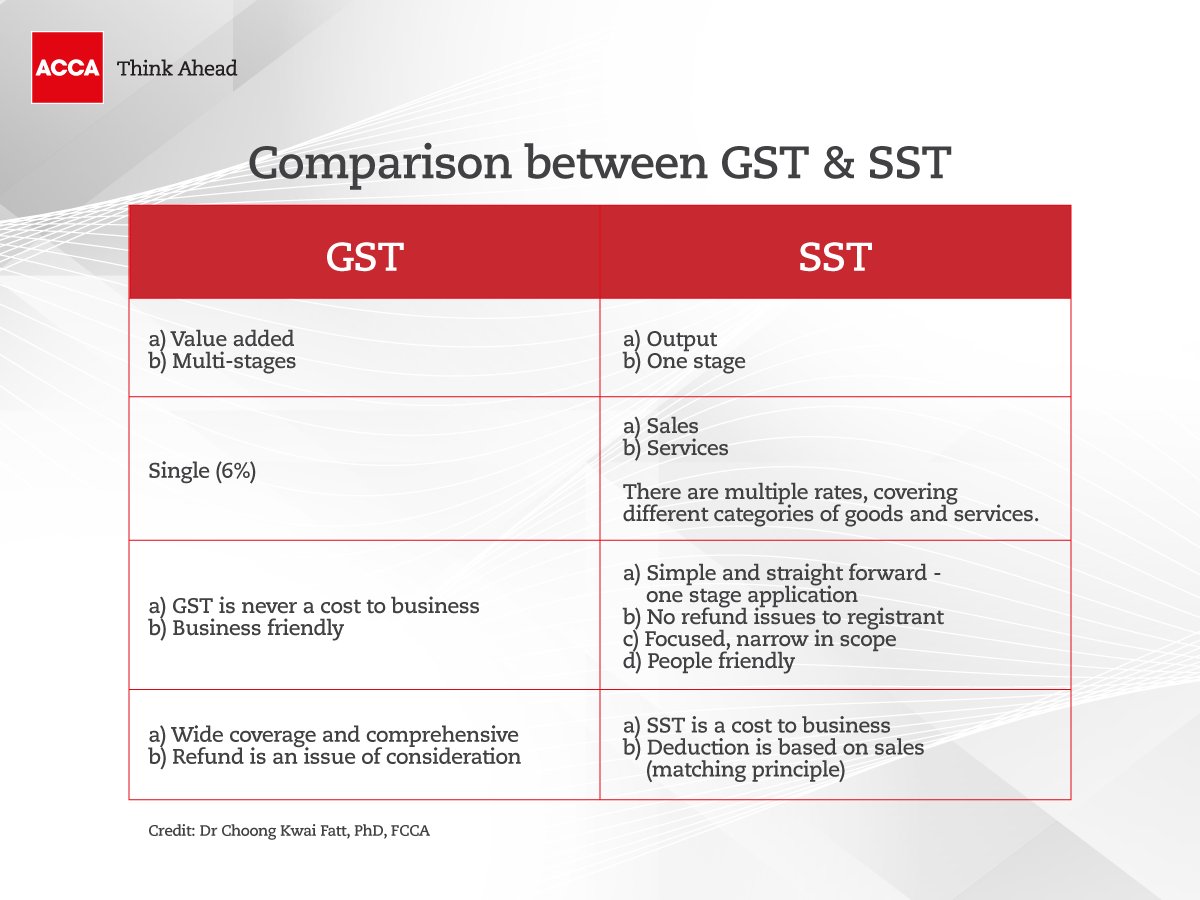

These are taxable supplies that are subject to a zero rate. An industry hopeful of the benefits that Malaysias latest tax changes will bring is reacting in different ways as the zero-rated goods and services tax GST policy kicks into place starting today until August 31 after which it will be replaced by the sales and services tax SST from September 1.

How Is Malaysia Sst Different From Gst

Download form and document related to RMCD.

. Your services are considered international services which are zero-rated ie. SR 0 vs. Goods and Services that fall under each category predetermined by the Royal Custom Department of Malaysia.

After Pakatan Harapan won the 2018 Malaysian general election GST was reduced to 0 on 1 June 2018. Some inbound agents are proactively working to reflect the new zero-rated. Today PhAMA president Yew Wei Tarng said merely placing medicines under the National Essential Medicine List NEML under the GSTs zero-rated category would result in a negative impact to the country.

In other words no effect la so we dont have to go too deep into this. November 16 2021 The Goods and Services Tax GST Board of Reviewin a decision favourable to the traderaddressed the tax authoritys decision to deny zero-rating for exports of goods that were hand-carried by motor vehicle to customers in Malaysia. Depending on the nature of your services you may be required to determine your customers belonging status ie.

The Goods and Services Tax GST will be set at zero percent beginning June 1 2018 says the Finance Ministry. Malaysia GST Types of Supply. By zero-rating the rights of the taxpayers to claim input tax within six years are sustainedZero-rating essentially means changing your tax code percentage from 6 to 0.

Wednesday 16th May 2018 The Goods and Services Tax GST will be zero-rated for all items and services in Malaysia from June 1 2018 the Finance Ministry announced today The ministry said the GST will no longer be imposed at a rate of 6 per cent from then on adding that this will be subject to further notice. The second policy is the change in GST rate of six per cent to zero from today onwards and the expected introduction of the Sales and Service Tax SST system in September which the report said will likely reduce the CPI by a similar 02 to 03 percentage point. Malaysia will implement the GST starting this April 1.

From 1 June 2018 Malaysias Goods and Services Tax will be zero-rated while the Sales and Services Tax is expected to make a comeback. Whether the customer is. GST shall be levied and charged on the taxable supply of goods and services.

GST shall be levied and charged on the taxable supply of goods and services. Comptroller of Goods and Services Tax 2021 SGGST 1 Summary. Many domestically consumed items such as fresh foods water and electricity are zero-rated while some supplies such as education and health services are GST exempted.

View gst-malaysia-zero-rated-supply-listpdf from AA 1In House GST Workshop for Group Tell Your Friends about Us CLICK TO VIEW. This is because most medicines sold here do not fall under the NEML according to Yew. Association of Private Hospitals of Malaysia president Datuk Dr Jacob Thomas had also said the APHM wanted to know if the 2900 brands of.

Businesses are eligible to claim input tax credit in acquiring. The prime minister stated 2900 essential medicines would be exempted from the GST but did not specify the category. Under the scope of Goods and Services Tax GST in Malaysia supplies fall into 4 categories.

The existing standard rate for GST effective from 1 April 2015 is 6. While the decision of bringing back the Sales and Services Tax SST is not yet finalised companies in Malaysia need to prepare themselves adequately to avoid any penalties and ensure smooth business operations. In a statement the Ministry said that the reduction of the rate from the current 6 to 0 will be implemented nationwide until a further announcement is made.

If you have an abrupt cut-off of GST or repeal of GST they may not be able to claim the input tax in the future. So the standard-rate will automatically become zero-rated come 1 June but exempt supply will remain exempted from tax. They are standard rated supplies zero rated supplies exempt supplies and supplies not within the scope of GST.

In Malaysia theres standard-rated which is 6 zero-rated 0 and exempt GST. GST is charged at 0 if they fall within the provisions under Section 21 3 of the GST Act.

Post Ge14 Gst To Be 0 From June 1 But M Sians Still Have Questions

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Interactive Gst A Cure For Deficits The Star

Gst Better Than Sst Say Experts News Summed Up

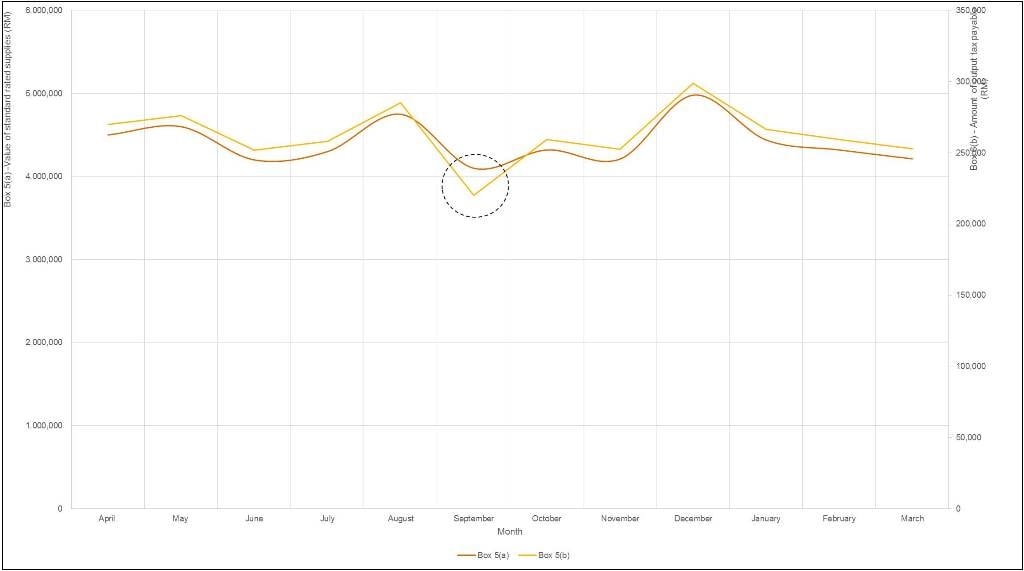

The Amount Of Monthly Gst Collections Has Reached Trillion Marks For The First Time Since The Beginning Of Gst Registration Which Ind Trillion Marks Banksters

Things You Need To Know About Malaysia Gst Abolishment

How Is Malaysia Sst Different From Gst

تويتر Accamalaysia على تويتر As We Bid Farewell To Gst And Welcome Back Sst It Is Crucial To Understand The Differences Between These Taxes Learn About The Taxes Today And Seize

Pdf Goods And Services Tax Gst Transition To Sales And Services Tax Sst Impact On The Welfare Of B40 And M40 Households In Malaysia

Notice Gst Zero Rated Effective On June 2018 Enagic Malaysia Sdn Bhd

Pdf The Impacts Of Goods And Services Tax Gst On Middle Income Earners In Malaysia Zulaika Nadhirah Academia Edu

Gst For Today Tomorrow And Beyond Kinibiz

Malaysia Gst Item Master Tax Setting Accounting Erpnext Forum

Malaysia S Zero Rated Gst A Move Forward Or Several Steps Back Priority Consultants

Pdf The Adoption Of Gst In Malaysia Lessons Not Learned And A Few New Paths